Bài viết sau đây sẽ cung cấp cho bạn đầy đủ kiến thức và nội dung về he regrets applying for the job in that company mà bạn đang tìm kiếm do chính biên tập viên Làm Bài Tập biên soạn và tổng hợp. Ngoài ra, bạn có thể tìm thấy những chủ đề có liên quan khác trên trang web lambaitap.edu.vn của chúng tôi. Hy vọng bài viết này sẽ giúp ích cho bạn.

Kenneth Charles and Matthew Phair sat on opposite sides of the conference room table, scratching away on their legal pads. As one voice after another leaked from the starfish-shaped phone, Matthew, the CFO of First Rangeway Consulting, took copious notes. Kenneth, the CEO, energetically doodled animals, as he often did when alone or with close associates. “During a conference call, no one can tell that you’re drawing a dog,” he liked to say, beaming approval on those who got the joke.

Doodling helped Ken focus, and his pen skittered across the paper as he listened to Victoria Michaels, a top-ranked sell-side analyst covering professional services stocks. Victoria was commending First Rangeway for its cost-control work and consequent increase in earnings. “But revenues are still flat quarter over quarter,” she went on in a clipped voice that just missed being an English accent. “When and from where do you see revenue growth, and at what levels?”

“You know, Victoria, we’ve been holding client projects steady over the past year,” Ken replied. “But proposal activity and engagement types point to an uptick next quarter, when corporate spending for our services should really kick in.”

“We’ve already seen signs that we’ll easily reach the targets we mentioned earlier,” added Matt, jotting a number in the margin and drawing a box around it. “To reiterate, we stated a 10% quarter-over-quarter increase beginning next quarter.”

The next question, from Kevin Danville of LRL Investments, was tougher. “Could you comment on how fruitful the business process outsourcing space might be over and above traditional consulting revenues?” Kevin asked, as Matt etched “BPO” into his paper, followed by three question marks.

Ken racked his brain for a response that would sound both encouraging and noncommittal. Not finding one, he settled for noncommittal. “We are investigating multiple revenue streams as we have in the past,” he said, “and are prepared to move into those that complement our consulting work. However,” he added, cringing inwardly at the necessarily oblique language, “it would be premature at this point to make any specific announcement.”

That answer wasn’t what the analysts wanted to hear, he knew. Although Ken had been a partner at First Rangeway since 1997—two years before the 2,800-employee consultancy’s IPO and subsequent market triumph—he had been CEO for less than a year, and the quarterly analyst calls still made him sweat. On the day he accepted the top job, his wife, Cara, had presented him with a plaque that read simply, “All Things to All People,” and for months it held pride of place on his office wall. Lately, however, the words seemed more like a command than a pleasantry, and Ken had banished the plaque to the nether regions of a desk drawer.

Thirty question-filled minutes later, the call operator finally rang down the curtain. Ken capped his pen and leaned back, puffing out his cheeks in relief. Matt tapped the on/off button on the speakerphone to make sure they were clear. The reassuring hum of a dial tone filled the air.

“Have I ever mentioned how much I love analyst calls?” said Ken, as Matt gathered his papers into a neat stack. “Because if I did, I was lying. How do you think my BPO response went over?”

Matt shrugged. “Kevin didn’t mention Locklin-Ladd Associates by name, but you know that’s who he meant. They’ve been all over outsourcing, and they’ve hired some top guns to make it happen. There’s money there, Ken. It could easily mean 30% growth for us for several years. Plus, Mark and Amy and some other partners have serious experience in that area.”

“It would also mean a ton of up-front capital,” replied the CEO. “But yes, it’s worth considering.” Certainly the prospect was tantalizing, and Ken couldn’t deny feeling that residual dream-big itch, which, without access to heaps of money, the company was unlikely to scratch. None of the new markets First Rangeway was contemplating were frivolous; all represented directions in which its customers were heading. Five years ago, pursuing such opportunities would have been a no-brainer. But after the market’s fall, it was definitely a brainer. For that reason and others, Ken was no longer convinced that public status remained a compelling proposition. “Of course,” he mused out loud, “the whole equation changes if we…”

“If we go private,” concluded Matt. “It’s item number one at the next management team meeting—and the big item at the board meeting.” Leaning across the table, he tore the top sheet off Ken’s pad and eyeballed it. “Nice giraffe,” he commented, tossing the paper back toward the CEO.

A Troubling Exchange

An hour later in the lobby, Ken stopped by the reception desk to order a cab and snitch a handful of Hershey’s Miniatures from the cut-glass jar. “I thought you were on a diet?” said Lindsey Carruthers, coming up behind him. One of First Rangeway’s rising stars, Lindsey was also Ken’s self-appointed conscience. The CEO raised his hands in mock surrender and put back the candy. The two walked out together through the big glass double doors.

“I’m glad I ran into you,” said Ken, scanning the street for his taxi. “I’m off to your alma mater in Boston to do a presentation at the B-school—trying to rustle up some top-notch MBAs. You’ve done a lot of recruiting there, right? What will they throw at me?”

Lindsey thought for a moment. “Well, they’re still interested in First Rangeway, definitely,” she said. “But I had lunch with a couple potential recruits last week, and they were concerned about the stock price. I’m not surprised, because we’re so option- and stock-based, but they asked questions about the stock’s potential I really couldn’t answer. Want me to come with?”

“No, you just enjoy your lunch,” said Ken, as his cab pulled up. Through the window, he watched Lindsey walk toward the corner salad bar. She was one of his best people and would probably make partner soon. In its glory years, First Rangeway had recruited a lot of great people from her school, many attracted by those very stock options that were giving this crop of MBAs the willies.

And why shouldn’t options make them uncomfortable, Ken thought. First Rangeway’s price was more than 80% off its highs, and volatile to boot. With the precipitous drop in global business, they’d downsized dramatically, laying people off, freezing hires. But things were looking up now. It was time to refocus on the people—on finding new blood to drive the business and hanging on to those partners who had made it successful so far.

Unfortunately, they would have to divert some of those new hires toward activities that would do nothing to build the company. Before that morning’s analyst call, Matt had laid out the resources First Rangeway needed to stay up to snuff with Sarbanes-Oxley, SEC filings, and other cost-of-being-public requirements. The business was becoming more complicated: Innovative revenue and gain-sharing agreements with clients had made financial reporting a mare’s nest. Matt estimated they’d need 12 more people, including in-house attorneys, audit staff, and dedicated systems folk to upgrade software for internal controls. He had ballparked the total at over a million dollars annually.

Cutting corners wasn’t an option, Ken knew. Anything remotely questionable about their reporting could hinder a potential rebound in stock price or—worst of worst-case scenarios—land him and Matt in jail for willfully certifying bad financial statements. “Neither of us wants to sign off on those filings unless they’re 100% kosher,” Matt had reminded him. “And by the way, we could also use two or three more bodies in investor relations.”

The cab lurched, and a wave of nausea seized the CEO. Car sickness, nerves, or an empty stomach? Ken unwrapped the single chocolate bar he had secreted in one of his pockets and popped it into his mouth.

Too Bullish to Bear?

The presentation to the MBAs went swimmingly. Ken was justifiably proud of his oratory skills: The ability to motivate people was one factor in his professional rise. So inspirational was the CEO’s description of his company’s starry future that he was tempted to run out and apply for a job at First Rangeway himself.

Crossing the quad afterward, Ken noticed a tall woman in head-to-toe Brooks Brothers striding ahead of him. He quickened his pace and a moment later fell in beside Nancy Westview. Nancy was a prominent business personality, adored by the press, and had more pies than she had fingers to put in them. She was on campus that day guest lecturing at an entrepreneurship seminar. “I went in with six pages of notes and came out with 600 pages worth of business plans,” she told Ken, waving a thick folder. “My favorite so far is an exercise service for small pets.”

Xem thêm: Top 20+ thú ăn thực vật chính xác nhất

But small talk was a very small part of Nancy’s conversational repertoire. One of First Rangeway’s original investors (she still held a sizable position) and a member of its board, she soon switched to a subject of vital interest to the shareholders—and, most particularly, to Nancy Westview. “I know there’s been a lot of talk recently about going private,” she said, stepping neatly off the path to avoid a young professor on a Segway, “and I think it would be a mistake. The major indexes are all up for the year, and our stock is up twice that. The economy looks as if it’s gaining steam, and I don’t want it leaving the station without us.”

Ken listened patiently as Nancy launched into a tutorial on the state of technology consulting. As expected, it was a study in upsides. Nancy’s estimates of potential revenues from outsourcing slightly exceeded Matt’s, and she knew from her prodigious networking that some of First Rangeway’s competitors were entering other promising areas. There was also talk of industry consolidation: Nancy named three potential acquisitions that she deemed “tasty.”

“There is no way we can talk about going private without taking these things into account—serious account,” said Nancy, as they emerged from the grassy enclave onto a revving-up-for-rush-hour street. “I want to know what we’re doing about these opportunities. The board meeting is Wednesday. I expect to hear answers.”

“And answers you will have, Nancy,” promised Ken, the first words he’d been able to get out in almost ten minutes. “Matt and I are still in research mode, but a direction is becoming clear.” The last bit wasn’t true, but Nancy, he knew, had a hate-hate relationship with ambiguity. Anxious to avoid a further monologue, he handed her into the first cab that pulled up, declining her offer to share the ride. As Ken raised his hand to hail another taxi, a bus rolled by, belching exhaust at him.

Public Enemy Number One

Ken arrived at his club at ten minutes past seven and hurried to the restaurant. The floor-to-ceiling windows were awash with night, and waiters slipped unobtrusively from table to table, lighting candles. Greg O’Keefe was already seated in their usual spot. Ken dropped into his chair and brushed away the leather-bound menu being proffered by a waiter. “Flame-grilled rib eye, black-and-blue. No potatoes. No bread. Glass of the house red.”

“Atkins, Ken?” asked Greg, raising an eyebrow.

“Ten pounds so far,” replied Ken, not mentioning that two of those ten had recently made a reappearance. “And how about you?” he asked, noticing the tautness of his former colleague’s jacket across his increasingly barrel-like chest. “Evidence of life in the slow lane?”

“Nothing slow about it,” said Greg. “I’ve got plenty of consulting work, and, seeing as I’m a bred-in-the-bone consultant, that tends to make me happy. Can you say the same?”

“Of course,” replied Ken, slightly annoyed. “First Rangeway is still a consulting firm through and through.”

“Oh yes?” said Greg. “And a consulting firm through and through needs access to all that capital why? Consulting is a cash-based business, old friend. The math is simple: If 200 partners generate $200 million in profits, they each make a million dollars. All being public does is dilute that.”

Ken sighed, wondering how they had managed to get off on this track so early in the evening. They’d been having the same argument for three years, beginning on the day Greg resigned from First Rangeway in the second wave of partner defections after the business downturn. Ken had bought into the former CEO’s ambitious vision. But Greg saw only what was lost: an unwavering focus on consulting.

Greg had launched into his by-now familiar interpretation of events. “Because we were so fantastic at what we did, we were able to pull off a successful IPO, which gave us lots of money to spend on things other than what we did and were fantastic at. It’s a catch-22 or a perfect storm or a tipping point…I can never remember which. I’m not arguing there isn’t value in floating a small percentage of stock and gaining liquidity. But after that, what’s the use?” he continued as the waiter placed a couple of green salads in front of them. He paused to fork some arugula into his mouth. “Private may not be sexy, but these days public isn’t anything to get hot and bothered about either. The privately owned consulting model has been working for decades. Decades from now, it will still be working.”

Ken scooped his croutons onto a spoon and deposited them onto his bread plate. “Look, Greg, do I really need to state the obvious here? We are profitable. Proposal interest is up. The economy is up, and we’re in a great position to take advantage of that. Without the IPO, we wouldn’t have had these gains. And if we go private now, we’ll miss out on a lot of opportunities that the board—that the board and I—see in the coming year.” He paused, realizing he was repeating some of the same rah-rah rhetoric he’d used on the MBA candidates a few hours earlier. “Anyway, you know the door is always open if you want to come back,” he said more gently.

“Well, Ken, if anyone can make it work, it’s you,” said Greg, conciliatorily. “Personally, I think First Rangeway’s gonna do great things. But it’s going to have to do them without me.” He smiled. “Unless of course, you change your mind about the private thing. Are you going to eat those croutons?”

P.O.’d

Closing the door of his den to stifle the sound of the Cartoon Network marathon unfolding in the next room, Ken sat at his desk and switched on the PC. He had an hour before the Saturday routine of soccer games and birthday parties kicked in, and about 100 e-mails to plow through. One from his brother in Maine. One from Amazon announcing that a recent order was on its way.

The third e-mail was from Tracy Durham, president of Bardwell Incorporated, and a longtime client of Ken’s. The previous year, Bardwell had initiated a multimillion-dollar engagement, and the e-mail bore glad tidings of its progress. Tracy reported that she was pleased with the Rangeway partner running the project. The team of employees from both companies had proven innovative and collaborative, its results solid. “I do, however, have one issue I’d like to discuss,” the e-mail concluded. “Call me when you can.”

Ken checked the date and time stamp: 10/11/03 08:32 am. Tracy was hard at it on a Saturday morning; it wouldn’t hurt to let her know Ken was hard at it, too. Anyway, Ken couldn’t enjoy the day knowing there was some problem out there preparing to bite. He had Tracy’s cell number and had been instructed to use it any time. Ken picked up the telephone.

Two rings. “Hello?”

“Hey, Tracy, I hope it’s OK to call you on a weekend…”

“Not a problem, Ken. I guess you saw my e-mail. As I said, things in general are going well. But some of our people have complained that some of your people are pushing them too hard to reach certain milestones on the programming project before end of quarter.”

Unconsciously, Ken picked up a pad and began doodling. Bardwell’s compensation and culture, Tracy was explaining, simply weren’t designed to accommodate 75-hour-plus workweeks. And the lead partner—whose energy and expertise she had praised in the e-mail—had been a little too aggressive about collecting on a bill (“and I let him know it, too,” said Tracy, sounding peeved.) “I don’t object to wrapping things up quickly,” she continued. “But all of the pressure makes us wonder, Whose quarter are we trying to make: Bardwell’s or Rangeway’s?

“Making a quarter can’t help a firm as much as losing a client could hurt it,” Tracy said. “Right now this is not a huge thing.” She paused, waited a beat. “Let’s just make sure it doesn’t become one.”

Ken’s pen was leaking, leaving moist blotches all over the page. This wasn’t the first time a project team had been pressured in the name of quarterly revenue targets. And clients weren’t the only ones hurting: His own employees were complaining of burnout as well. “I promise I’ll speak to the engagement partner personally,” he said hastily. “You’ve known me a long time, Tracy. You know we’ll do right by you.”

Xem thêm: Top 20+ đánh người là hành vi xâm phạm tới quyền chi tiết nhất

As Ken hung up, a chorus of voices summoned him into the living room to join the search for cleats.

Time to Yield?

On Monday morning, Ken’s conversation with the lead partner on the Bardwell engagement went as well as could be expected. (“Did I really use the word ‘unseemly’?” he asked himself later.) By 11 am, the CEO had moved on to other things. Specifically, he was back in the conference room with Matt, the speakerphone between them. Only this time, it was channeling the voice of investment banker Charlie Gremley.

“Going private is a pretty straightforward process,” Charlie was explaining, “but that doesn’t mean it’s easy. If you plan to raise capital from financial sponsors, we can help you do that. If you’re looking to raise the capital yourselves, we can help there, too. We’ll start running valuation models now if you like. Needless to say, we’re talking about something in excess of a couple of hundred million dollars.”

As the investment banker spoke, Ken speculated on just how much money the partners could or would raise if they went this route. After First Rangeway’s IPO, the owners’ net worth skyrocketed, and many had sold some piece of their ownership. But others held on as paper gains gave way to paper losses. Then Charlie started to enumerate the people they’d need to steer the deal, and Ken pictured attorneys and accountants swarming over the company’s headquarters like ants on a dropped popsicle. Talk about a distraction from the business…and the cost…

“There’s something extremely Alice Through the Looking Glass about all this,” remarked Matt as he switched off the phone. “I recall sitting right here five years ago listening to Charlie walk us through the IPO. Remember how helpful he was?”

“What I remember is how encouraging he was,” replied Ken, with a touch of sourness. “Did I mention how much I love investment bankers? Because if I did…”

“Yes, I know, then you were lying,” finished Matt.

Private Aye, or Nay

The management team meeting convened with the introduction of a tray of bagels and jugs of fresh-squeezed juice. It was 7:30, Tuesday morning. Ken gazed around the executive boardroom: The company’s brightest and most seasoned players gazed back at him. “So,” said the CEO, “may I direct your attention to the elephant in the room?”

Ken had ambitious goals for this meeting. Facing one of the most important decisions they would ever make, the team members couldn’t simply react to current market conditions or focus on their own careers and wealth. Rather, he needed them to step into the ring for a little out-of-the-boxing. They had to consider the issue from many different perspectives.

The CEO nodded toward Laura Leadbetter, a senior partner sipping a tall cup of Starbucks’s strongest. “Laura, if a client of our own strategy consulting group were wrestling with this issue, how might we advise them?”

As a 20-year veteran of business, Laura had facilitated more executive retreats than she could throw a creativity consultant at. Still, she mulled over the question a while before responding. “We all know there are big-money implications to either direction,” she said finally. “We want to do what is financially best for the business as a whole and, yes, for us individually. But—forgive me if I get a little Business Strategy 101 here—wealth comes through fulfilling client needs. So if I were advising a business, that’s what I would say: First, define your clients’ needs, and then align your genuine assets and business strategy, including capital structure, accordingly.”

That was the right answer, and Ken smiled his approbation. Customer focus had always been the CEO’s mantra. The team could paint this picture any number of ways, but First Rangeway’s clients had to provide the frame. Confident, now, that the discussion would proceed toward the best possible conclusion, Ken threw out this challenge:

“Being a publicly traded company affects us in almost everything we do. We have to consider not only what kind of business this can be, but also what it should be. What we are discussing now, and what I will present to the board tomorrow, is no less than the future of First Rangeway. Let’s talk.”

Chan Suh is cofounder, CEO, and chairman of Agency.com, an interactive marketing and technology company headquartered in New York. Agency.com went public in 1999 and private in 2001. Suh can be reached at [email protected].

Ken may not want to hear this, but I see no compelling financial reasons why First Rangeway should go private. The business opportunities before it are attractive. The company is profitable, and its cash flow appears healthy. (When my company, Agency.com, went private, the most important factor in my decision was the cash flow beyond 24 months.) So long as First Rangeway can remain profitable and keep customers happy, it should do just fine as a public company in the long term.

Going private, by contrast, could be hugely disruptive. The biggest challenge lies not with lawyers and accountants but rather with Ken’s own people. In a service company, as I’m sure Ken must know, people are everything. First Rangeway has been attracting top talent with a heavy reliance on the lure of options. If those options disappear because the company goes private, how will management induce those folks to stay? Options weren’t a disproportionate part of compensation at Agency.com, but we still had to come up with a bonus program to retain our key staff. And even then we lost a few, including our CFO. It’s not a question of loyalty. Those people signed on for one thing, and they ended up with something else.

But if First Rangeway stays public, I’m not sure Ken is its best possible CEO. If you don’t enjoy running a public company, then you shouldn’t be doing it. Ken should have known the realities going in: the emphasis on short-term results, the scrutiny. With every quarter comes that call of reckoning, and even when your results are bad or the questions are difficult, you have to enjoy at least the challenge of answering those questions. I actually did enjoy it, as well as the tremendous discipline required to meet expectations about reporting and performance.

As a public-company CEO, you’ve also got to be extremely straightforward. The analysts didn’t like the way Ken hedged on his response about business process outsourcing, and I don’t blame them. He should have just said, “Yes, we’ve thought about it. No, we haven’t made any decisions yet.” There’s a large difference between being a public-company CEO and playing a public-company CEO. The former tells the hard truths and takes his lumps; the latter spins everything, like a politician. I think Ken is still playing a public-company CEO. He’s ambivalent about communicating with the shareholder base, and that’s a huge part of his job.

To be fair, he also seems to regret all the time he’s spending away from his customers. Public companies have two sets of masters—shareholders and customers—and their CEOs must tend to both. When Agency.com was public, I spent about 40% of my time on shareholder-related matters; now that’s down to 10%, which is great. If First Rangeway is having trouble focusing on customers because its people are fixated on the stock market, then that might be a reason to privatize. That’s another people issue peculiar to service companies: When your sellable goods expire every hour, you can’t afford to have your people distracted from the client work.

If Ken insists on taking the company private, the first thing he has to do is start kissing some deep-pocketed frogs. And he must keep in mind that, whether he gets the money from existing partners or from new sources, those investors may be with him for a long time. And they won’t restrict their phone calls to once a quarter. Or even to business hours.

So, my recommendation stands. Ken, keep the company public, and learn to love the job. It can be very rewarding.

Ed Nusbaum is the chief executive officer of Grant Thornton, a global accounting firm focused on midsize private companies and mid-cap public companies. He is also a member of the Financial Accounting Standards Board Advisory Council. He can be reached at [email protected].

Going private is an attractive scenario for First Rangeway, assuming that it is able to raise the necessary cash. (Charlie Gremley, the investment banker, sounds optimistic on that score.) A number of factors support that judgment.

Xem thêm: Top 15 4 7 3 5 chi tiết nhất

As Ken has clearly discovered, it is easier to manage important decisions when you are not under public scrutiny. Private companies worry about profits, of course, but the pressure surrounding quarterly reporting is obviously hurting First Rangeway’s customers. It has also begun to take its toll on employees, who are working long hours and complaining about burnout. The analyst calls are creating stress for management and are proving a distraction from the company’s core business.

In addition, the impact of new legislation and reporting requirements on a company of this size is enormous. I would estimate that it costs First Rangeway somewhere between $250,000 and $1 million a year to remain public.

The stock price for a relatively small technology consulting firm such as First Rangeway is also likely to be very volatile in the future, and that may cause major financial and business disruptions. It’s not surprising that many of Ken’s best people were lured to First Rangeway by stock options. Options, as we know, are great when employees think their value is going to rise. But if it doesn’t, they are likely to become discouraged. In considering whether or not to stay public, Ken should worry not only about attracting the new talent he needs to drive the business but also about retaining the talent he already has.

Finally, the leadership team doesn’t seem to be chomping at the bit over the prospect of mergers or acquisitions, so First Rangeway is under little pressure to use its stock as currency.

If First Rangeway does decide to privatize, however, it will need to feel secure about its profits as it goes forward. The company is going to have to raise a couple hundred million dollars in financing—presumably in debt financing—and that will have an interest cost. If the company’s profits exceed that interest cost, then the difference will flow directly to First Rangeway’s partners or private equity holders. But if there are no profits, or if cash flow is not sufficient to make the principal and the interest payments, it will put a tremendous burden on the company. Analysts can and do get angry over poor performance, and Ken is understandably concerned about that. But private debt holders can put you out of business.

The final deciding factor in this scenario is First Rangeway’s board. I believe that the board will support a privatization strategy if such a strategy makes sense from both an economic and a business standpoint. Its members have a fiduciary responsibility to do what is in the best interests of the shareholders, and Ken can make a strong case that, because of the volatility of the market and the industry, it is in the shareholders’ best interests to be bought out. If Ken is convincing on that point, even Nancy Westview, the board member who strongly advocates that First Rangeway remain public (and whose opinions may not be representative of those of the other members), will be unable to effectively object to the company pursuing a privatization strategy.

First Rangeway Consulting could undoubtedly continue to operate as a public company, and Ken and Matt still need to run some economic models and draw up their own list of pros and cons before making any critical decisions. But if I were in their shoes, I would soon begin the push toward going private.

John J. Mulherin is the president and chief executive officer of the Ziegler Companies, a boutique investment-banking firm serving the not-for-profit sectors of senior living, hospitals, education, and churches. The company is based in Milwaukee. Mulherin can be reached at [email protected].

My business, the Ziegler Companies, traded for ten years on the American Exchange, and we would still be trading there today if it weren’t for the passage of Sarbanes-Oxley. Yes, the system needs real reform with teeth in it. But one size does not fit all, and micro-caps are suffering disproportionately.

First Rangeway’s CFO, Matt, put a $1 million price tag on complying with new and existing regulations, and he didn’t even address the high level of distraction Sarbanes-Oxley foments. Had Ziegler remained on the Amex under Sarbanes, we would have had to recreate our audit committee practices and charter. These mandates would also have meant adding numerous meetings and committees, as well as implementing some costly financial-risk and compliance processes that overlap with our existing and more-efficient processes.

Our start-up costs for compliance are estimated at $700,000; we believe that ongoing costs would have run $400,000 annually. Taken together, that’s 20% to 25% of our bottom line for 2003. It sounds as though First Rangeway would be similarly hit.

What Ziegler ultimately chose to do—and what might work for First Rangeway as well—is to remain public but list on the Pink Sheets, a primarily over-the-counter mechanism for trading companies that are not on the major exchanges. Long considered the refuge of penny stocks and fallen angels, the Pink Sheets, which is electronic and Internet-accessible, has lately attracted a growing number of reputable firms and strong performers. As many as five to ten companies a week are signing on specifically to avoid the costs imposed by Sarbanes-Oxley. However, many people are unaware of the service’s improvements and remain suspicious of its reputation, so Ken may have difficulty persuading his board that the Pink Sheets is an option.

But the first question that Ken faces isn’t whether the Pink Sheets is a better venue for staying public than First Rangeway’s current exchange. Rather, it is, who are First Rangeway’s shareholders, and what is the company really doing for them?

The CEO offers little insight into how he intends to build shareholder value, and that may be because he doesn’t have much in that way to offer. First Rangeway, after all, is a consultancy. That means its revenues are largely nonrecurring, and it has neither significant tangible assets such as inventory, nor intellectual property such as patents. At its core, the company is comprised of a group of people laboring together for their mutual benefit. Is there really a compelling reason for a company with this business model to be public at all? Some members of my executive team argued the very same thing about Ziegler when we were debating its privatization last fall.

I would also question whether privatization is the most important issue for debate. During my tenure at Ziegler, I have spent less time mulling over our capital structure than our business strategy. Is our strategy working? If not, how do we fix it? Do we close existing businesses? Start new ones? Redirect our resources? Improve our marketing? Ken appears to be focusing most of his attention on the public-private quandary instead of on those issues most likely to build sustainable value for shareholders.

If Ken believes that First Rangeway is truly creating value, then by all means it should remain public (but consider listing on the Pink Sheets in order to escape the excessive burdens of Sarbanes-Oxley). If he can’t make that argument—and I suspect he can’t—then privatizing is the better choice.

Tom Copeland, formerly the chair of the finance department at UCLA, is the managing director of corporate finance at the Monitor Group, a management consulting firm based in Cambridge, Massachusetts. He is coauthor of Real Options: A Practitioner’s Guide (Texere, 2001). He can be reached at [email protected].

A consulting firm functions best as a partnership because it depends on creative solutions to high-level problems. Because information is inalienable (once shared it cannot be returned to its owner) and because new ideas must be quickly disseminated, a flat structure based on trust works best. From an organizational standpoint, therefore, First Rangeway’s IPO did the company no favors. It also caused significant increases in agency costs (monitoring, public reporting, performance expectations, and incentive structure) that may have driven a wedge between the public shareholders who own but do not manage the firm and the remaining post-IPO partners who manage but do not own it.

First Rangeway’s IPO most likely transferred wealth from junior to senior partners, who owned a disproportionately large percentage of the firm. In addition, by creating a new class of outside owners, the IPO raised agency costs in three ways. First, the outsiders need to monitor management: First Rangeway spends $1 million annually on SEC compliance and related charges. Actual opportunity costs will be a significant multiple of that. Second, senior partners’ incentive to push harder evaporates because they have essentially cashed out. Third, the remaining partners’ incentive declines substantially because they now keep only a fraction of the fruit of their efforts. Things would have been different had the IPO money been reinvested in growth, but that didn’t seem to happen.

The $200 million of profit would have been paid out as additional bonuses when the firm was a partnership. Senior partners created a wealth transfer and initiated agency costs by selling the claim on the stream of profits to outside owners. Post-IPO, it must have become harder to attract and retain top talent because the percentage of the total pie allotted to the partnership declined, as did the size of the pie.

While debating what First Rangeway’s status should be in 2004, Ken and Matt should understand what might have been done differently in 1999. Back then, the senior partners should have sold their shares to the junior partners rather than to the public. The firm’s charter should have separated ownership from control within the ranks of the partnership to solve a classic intergenerational problem: transfer of ownership. This can be facilitated by separating voting rights from stock ownership. When junior consultants are elected to partnership, they must buy shares from senior partners, who are required to sell. Over time, the number of shares owned by individual partners increases, then declines as retirement approaches. The number of votes, meanwhile, increases with seniority. Thus, control rests with senior partners, but their economic incentive to sell the firm to outsiders diminishes to zero as they prepare to retire. Capital for growth should be raised primarily via borrowing.

If First Rangeway’s remaining partners can eliminate the agency problems created by the IPO, then the firm’s value after privatization will exceed the buyback price. Monitoring costs will disappear, and internal incentives will improve. If the partners cannot resolve those issues, then the public-private dilemma will continue to haunt them. With a second IPO likely, the agency cost would remain and privatization would create little or no value.

The remaining partners must decide whether it is easier to exceed expectations as a publicly held company or as a partnership. Will increased incentives improve consultants’ performance? I believe so. The partners must also be sure that they can improve current expectations of the key value drivers: growth and operating margins. If they have to borrow to finance the buyback, they may have a debt burden for years to come.

Top 19 he regrets applying for the job in that company tổng hợp bởi Lambaitap.edu.vn

PHẦN D: VIẾT I. Viết lại câu bắt đầu bằng từ gợi ý sao cho nghĩa của câu không thay đổi 1. Mary didnt apply for the job in the company and regrets it

- Tác giả: mtrend.vn

- Ngày đăng: 03/23/2022

- Đánh giá: 4.99 (806 vote)

- Tóm tắt: PHẦN D: VIẾT I. Viết lại câu bắt đầu bằng từ gợi ý sao cho nghĩa của câu không thay đổi 1. Mary didn’t apply for the job in the company and regrets it now.

- Nguồn: 🔗

Paradox boss says he regrets &34inappropriate behaviour&34 during company meeting

- Tác giả: eurogamer.net

- Ngày đăng: 06/08/2022

- Đánh giá: 4.79 (366 vote)

- Tóm tắt: The leak came just as Wester, CEO back in 2018, returned to the company’s top job. Ebba Ljungerud, who served as CEO in the intervening couple …

- Nguồn: 🔗

Mark the letter A, B, C, or D on your answer sheet to indicate the sentence that best combines each pair of sentences in the following questions

- Tác giả: tuyensinh247.com

- Ngày đăng: 07/04/2022

- Đánh giá: 4.56 (375 vote)

- Tóm tắt: She regrets it now. … C. Susan regrets applying for the job in the library. … A. Hardly had he informed us about his investment in the company when Hans …

- Nguồn: 🔗

Biến đổi câu: He regrets applying for the job in that company

- Tác giả: hoc247.net

- Ngày đăng: 05/09/2022

- Đánh giá: 4.33 (513 vote)

- Tóm tắt: He wishes he hadn’t applied for the job in that company. Theo công thức: Regret + to V: hối tiếc làm gì Regret + V-ing: hối tiếc vì đã làm gì.

- Nguồn: 🔗

Xem thêm: Top 13 it came as no surprise

Viết lại câu sao cho nghĩa ko đổi ?

- Tác giả: hoidap247.com

- Ngày đăng: 02/14/2022

- Đánh giá: 4.16 (206 vote)

- Tóm tắt: He regrets applying for the job in that company He wishes…

- Nguồn: 🔗

Boeing CEO regrets losing 660M on Trumps Air Force One deal

- Tác giả: aa.com.tr

- Ngày đăng: 01/30/2022

- Đánh giá: 3.88 (242 vote)

- Tóm tắt: The Boeing CEO has said he regrets the company losing $660 million … higher cost to finalize technical requirements and schedule delays,” …

- Nguồn: 🔗

Exercise 2: Biến đổi câu1. He regrets applying for the job in … – Hoc24

- Tác giả: hoc24.vn

- Ngày đăng: 02/28/2022

- Đánh giá: 3.52 (529 vote)

- Tóm tắt: 1. He wish he could apply for the job in that company. 2. The headmaster insists that every schoolgirl’s must wear ao dai every Monday. 3 …

- Nguồn: 🔗

4 ways to avoid career regret before starting a new role

- Tác giả: roberthalf.com.sg

- Ngày đăng: 07/02/2022

- Đánh giá: 3.24 (352 vote)

- Tóm tắt: Do your research before applying. Many professionals simply aren’t doing their homework before they submit their resume to a potential employer.

- Khớp với kết quả tìm kiếm: If the company is truly interested in hiring you, then they will make the effort to help you collect the information you need to say “yes” to their job offer with enthusiasm — and hopefully, avoid feeling any career regrets after you join the …

- Nguồn: 🔗

Choose the best answer among A, B, C or D that best completes each sentence. We Dorothy since last Saturday. A. don&x27t see B. haven&x27t seen C. didn&x27t see D. hadn&x27t seen

- Tác giả: kienrobo.kienguru.vn

- Ngày đăng: 07/24/2022

- Đánh giá: 3.04 (422 vote)

- Tóm tắt: Susan didn’t apply for the job in the foreign company and regrets it now. … He is the (41) ______ who provides us with money to feed an.

- Nguồn: 🔗

Xem thêm: Top 10+ câu chuyện đồng tiền vàng

Having Regrets About Your Job? Put Them To Work For You

- Tác giả: forbes.com

- Ngày đăng: 03/25/2022

- Đánh giá: 2.86 (118 vote)

- Tóm tắt: I write about rising and thriving in today’s global corporate world. … This approach can apply to jobs, too. Make a choice.

- Khớp với kết quả tìm kiếm: On the other hand, some second-guessing is natural, and we do want to take stock of current choices to help guide future ones. And feelings of regret can provide information we need. As author Daniel Pink puts it in his recent book, The Power of …

- Nguồn: 🔗

Mark the letter A, B, C, or D on your answer sheet to indicate the sentence that best combines each pair of sentences in the following questions Susan didnt apply for the job in the library. She regrets it now

- Tác giả: hamchoi.vn

- Ngày đăng: 07/08/2022

- Đánh giá: 2.8 (81 vote)

- Tóm tắt: She regrets it now … C. Susan regrets applying for the job in the library … Thousands of companies, universities, governments, and other (26) ______ …

- Nguồn: 🔗

Wishes and regrets – I wish / if only

- Tác giả: test-english.com

- Ngày đăng: 12/13/2021

- Đánh giá: 2.68 (180 vote)

- Tóm tắt: Choose the correct option to complete the sentences. Page 1 of 2. 1 I wish I ______ a better job. I don’t …

- Nguồn: 🔗

Mark the letter A, B, C, or D on your answer sheet to indicate the sentence that is closest in meaning to each of the following questions. Lan didn’t apply for the job in the library and regrets it now

- Tác giả: khoahoc.vietjack.com

- Ngày đăng: 07/16/2022

- Đánh giá: 2.54 (153 vote)

- Tóm tắt: Dịch nghĩa: Lan đã không ứng tuyển cho công việc trong thư viện và hối tiếc về nó bây giờ. Phương án A. Lan wishes she had applied for the job …

- Nguồn: 🔗

Inflation pushes some workers to new jobs — and some regrets

- Tác giả: computerworld.com

- Ngày đăng: 09/28/2022

- Đánh giá: 2.54 (118 vote)

- Tóm tắt: For some, the ‘Great Resignation’ has become the Great Regret. … Even so, 78% of job seekers surveyed by the company still believe they …

- Khớp với kết quả tìm kiếm: “Do some people regret changing jobs? Of course they do. Buyer’s remorse is a fact,” said Lisa Rowan, a vice president for human resources software and services research at IDC. “[But] I think the cases mentioned [in Joblist’s survey] are being a …

- Nguồn: 🔗

Xem thêm: Top 11 thông điệp an toàn giao thông

4 Ways to Avoid Regrets When Quitting Your Job

- Tác giả: insights.dice.com

- Ngày đăng: 10/29/2022

- Đánh giá: 2.44 (73 vote)

- Tóm tắt: Lady with Regrets After Quitting Her Job … “shift shock” when they realize that their new job and company are not what they expected; …

- Khớp với kết quả tìm kiếm: Make a list of your top requirements; take stock of your interests, talent and skills, financial and educational goals, values, technical environment and lifestyle. To make sure that you’re up for the challenge, here are some free resources and …

- Nguồn: 🔗

Mark the letter A, B, C, or D on your answer sheet to indicate the sentence that is closest in meaning to each of the following questions. Lan didn’t apply for the job in the library and regrets it now

- Tác giả: qa.haylamdo.com

- Ngày đăng: 10/15/2022

- Đánh giá: 2.22 (119 vote)

- Tóm tắt: Phương án A. Lan wishes she had applied for the job in the library sử dụng cấu trúc: S + wish + S + had done sth = ước là đã làm việc gì trong quá khứ.

- Nguồn: 🔗

Quique Setien says he regrets not leaving Barcelona sooner

- Tác giả: barcablaugranes.com

- Ngày đăng: 12/13/2021

- Đánh giá: 2.19 (89 vote)

- Tóm tắt: Setien made it clear that he regrets how things went at Barcelona but makes it clear how the … Recapping Barca’s brilliant Italian job.

- Nguồn: 🔗

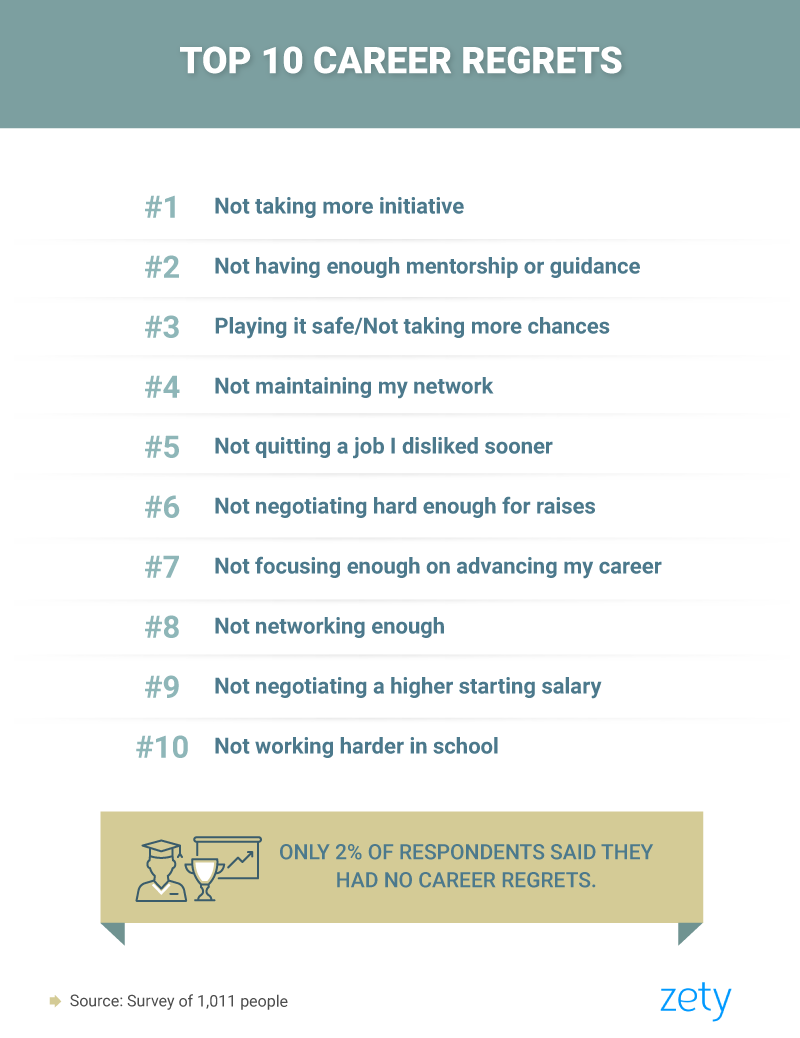

Biggest Career Regrets Revealed: Learn from Others Mistakes

- Tác giả: zety.com

- Ngày đăng: 03/13/2022

- Đánh giá: 2.15 (73 vote)

- Tóm tắt: Many people also said they regretted stewing in a less-than-ideal job and not leaving sooner. So what would it take for someone to actually …

- Khớp với kết quả tìm kiếm: When it came to taking risks, female respondents reported similar regrets about compensation, but at a much higher rate than men: Negotiating a raise was far and away the most prevalent risk women wished they had taken, at a rate of 40 percent more …

- Nguồn: 🔗

Susan didnt apply for the job in the library She regrets it

- Tác giả: tuhoc365.vn

- Ngày đăng: 02/20/2022

- Đánh giá: 1.92 (118 vote)

- Tóm tắt: Mark the letter A, B, C, or D on your answer sheet to indicate the sentence that best combines each pair of sentences in the following questions.Susan.

- Nguồn: 🔗