Bài viết sau đây sẽ cung cấp cho bạn đầy đủ kiến thức và nội dung về his policies were beneficial to the economy as a whole mà bạn đang tìm kiếm do chính biên tập viên Làm Bài Tập biên soạn và tổng hợp. Ngoài ra, bạn có thể tìm thấy những chủ đề có liên quan khác trên trang web lambaitap.edu.vn của chúng tôi. Hy vọng bài viết này sẽ giúp ích cho bạn.

By William Krist

Almost all Western economists today believe in the desirability of free trade, and this is the philosophy advocated by international institutions such as the World Bank, the International Monetary Fund, and the World Trade Organization (WTO). And this was the view after World War II, when Western leaders launched the General Agreement on Tariffs and Trade (GATT) in 1947.

However, economic theory has evolved substantially since the time of Adam Smith, and it has evolved rapidly since the GATT was founded. To understand U.S. trade agreements and how they should proceed in the future, it is important to review economic theory and see how it has evolved and where it is today.

In the seventeenth and eighteenth centuries, the predominant thinking was that a successful nation should export more than it imports and that the trade surplus should be used to expand the nation’s treasure, primarily gold and silver. This would allow the country to have a bigger and more powerful army and navy and more colonies.

One of the better-known advocates of this philosophy, known as mercantilism, was Thomas Mun, a director of the British East India Company. In a letter written in the 1630s to his son, he said: “The ordinary means therefore to increase our wealth and treasure is by Foreign Trade, wherein wee must ever observe this rule; to sell more to strangers yearly than wee consume of theirs in value…By this order duly kept in our trading,…that part of our stock which is not returned to us in wares must necessarily be brought home in treasure.”[1]

Mercantilists believed that governments should promote exports and that governments should control economic activity and place restrictions on imports if needed to ensure an export surplus. Obviously, not all nations could have an export surplus, but mercantilists believed this was the goal and that successful nations would gain at the expense of those less successful. Ideally, a nation would export finished goods and import raw materials, under mercantilist theory, thereby maximizing domestic employment.

Then Adam Smith challenged this prevailing thinking in The Wealth of Nations published in 1776.[2] Smith argued that when one nation is more efficient than another country in producing a product, while the other nation is more efficient at producing another product, then both nations could benefit through trade. This would enable each nation to specialize in producing the product where it had an absolute advantage, and thereby increase total production over what it would be without trade. This insight implied very different policies than mercantilism. It implied less government involvement in the economy and a reduction of barriers to trade.

The Theory of Comparative Advantage

Thirty-one years after The Wealth of Nations was published, David Ricardo introduced an extremely important modification to the theory in his On the Principles of Political Economy and Taxation, published in 1817.[3] Ricardo observed that trade will occur between nations even where one country has an absolute advantage in producing all the products traded.

Ricardo showed that what was important was the comparative advantage of each nation in production. The theory of comparative advantage holds that even if one nation can produce all goods more cheaply than can another nation, both nations can still trade under conditions where each benefits. Under this theory, what matters is relative efficiency.

Economists sometimes compare this to the situation where even though a lawyer might be more proficient at both law and typing than the secretary, it would still pay the lawyer to have the secretary handle the typing to allow more time for the higher-paying legal work. Similarly, if each country specializes in the products where it is comparatively more efficient, total production will be higher and consumers will have more goods to utilize.

Smith and Ricardo considered only labor as a “factor of production.” In the early 1900s, this theory was further developed by two Swedish economists, Bertil Heckscher and Eli Ohlin, who considered several factors of production.[4] The so-called Heckscher-Ohlin theory basically holds that a country will export those commodities that are produced by the factor that it has in relative abundance and that it will import products whose production requires factors of production where it has relatively less abundance. This situation is often portrayed in economics textbooks as a simplified model of two countries (England and Portugal) and two products (textiles and wine). In this simplified portrayal, England has relatively abundant capital and Portugal has relatively abundant labor, and textiles are relatively capital intensive whereas wine is relatively labor intensive. With these conditions, both nations would be better off if they freely traded, and under such a situation of free trade, England would export textiles and import wine. This would maximize efficiency, resulting in more total production of textiles and wine and cheaper prices for consumers than would be the case without trade. Through empirical studies and mathematical models, economists almost universally believe that this model holds equally well for multiple products and multiple countries.

In fact, economists consider this law of comparative advantage to be fundamental. As Dominick Salvatore says in his basic economics textbook International Economics, the law of comparative advantage remains “one of the most important and still unchallenged laws of economics. …The law of comparative advantage is the cornerstone of the pure theory of international trade.”[5]

The law of comparative advantage also holds equally well for many factors of production. In addition to labor and capital, other factors of production include natural resources such as land and technology, and these can be subdivided. For example, land can be land for mining or land for farming, or technology for making cars or computer chips, or skilled and unskilled labor. Additionally, over time factor endowments may change. For example, natural resources, such as coal reserves, may be used up, or a country’s educational system may be improved, thereby providing a more highly skilled labor force.

Furthermore, some products do not utilize the same factors of production over their life cycle.[6] For example, when computers were first introduced, they were incredibly capital intensive and required highly skilled labor. Over time, as volume increased, costs came down and computers could be mass produced. Initially, the United States had a comparative advantage in production; but today, when computers are mass produced by relatively unskilled labor, the comparative advantage has shifted to countries with abundant cheap labor. And still other products may use different factors of production in different countries. For example, cotton production is highly mechanized in the United States but is very labor intensive in Africa. The fact that factors of production may change does not nullify the theory of comparative advantage; it just means that the mix of products that a nation can produce relatively more efficiently than its trade partners may change.

Traditional economic theories expounded by Ricardo and Heckscher-Ohlin are based on a number of important assumptions, such as perfect competition with no artificial barriers imposed by governments. A second assumption is that production occurs under diminishing or constant returns to scale, that is, the costs of producing each additional unit are the same or higher as production increases. For example, to increase his wheat crop, a farmer may be forced to use less-fertile land or pay more for laborers to harvest the wheat, thereby increasing the cost of each additional unit produced.

Another key assumption of traditional economic theory is that basic factors of production—such as land, labor, and capital—are not traded across borders. Although Ohlin believed that such basic factors of production were not traded, he argued that the relative returns to factors of production between countries would tend to be equalized as goods are traded between the countries. Subsequently, Samuelson argued that factor prices would in fact be equalized under free trade conditions, and this is known in economics as the factor price equalization theorem.[7] This might mean, for example, that international trade would cause wage rates for unskilled workers to fall in the high-wage country in relation to the rents available from capital and to the same level as wages in the low wage country, and for wages to rise in relation to the rents available from capital in the low-wage country and equal to the level of the country where labor was less abundant. (The implications of this are important and are explored further in chapter 8.)

In static terms, the law of comparative advantage holds that all nations can benefit from free trade because of the increased output available for consumers as a result of more efficient production. James Jackson of the Congressional Research Service describes the benefits as follows: Trade liberalization, “by reducing foreign barriers to U.S. exports and by removing U.S. barriers to foreign goods and services, helps to strengthen those industries that are the most competitive and productive and to reinforce the shifting of labor and capital from less productive endeavors to more productive economic activities.”[8]

Many economists, however, believe that the dynamic benefits of free trade may be greater than the static benefits. Dynamic benefits, for example, include the pressure on companies to be more efficient to meet foreign competition, the transfer of skills and knowledge, the introduction of new products, and the potential positive impact of the greater adoption of commercial law. Thus trade can affect both what is produced (static effects) and how it is produced (dynamic effects).

Terms of Trade

Another important concept in international trade theory is the concept of “terms of trade.” This refers to the amount of exports needed to obtain a given amount of imports, with the fewer amount of exports needed the better for the country. The terms of trade can shift, either benefiting a country or reducing its welfare.

Assume that the United States exports aircraft to Japan and imports televisions, and that one airplane can purchase 1,000 televisions. If one airplane now can purchase 2,000 televisions, the United States will be better off; alternatively, its welfare is diminished if it can only purchase 500 televisions with a single airplane.

A number of factors can affect the terms of trade, including changes in demand or supply, or government policy. In the example given just above, if Japanese demand for aircraft increases, the terms of trade will shift in the United States’ favor because it can demand more televisions for each airplane. Alternatively, if the Japanese begin producing aircraft, the terms of trade will shift in Japan’s favor, because the supply of aircraft will now be larger and the Japanese will have alternative sources of supply.

Under certain conditions, improvements in a country’s productivity can worsen its terms of trade. For example, if Japanese manufacturers of televisions become more efficient and reduce sale prices, Japan’s terms of trade will worsen as it will take more televisions to exchange for the airplane.

A country can also adopt a beggar-thy-neighbor stance by deliberately turning the terms of trade in its favor through the imposition of an optimum tariff or through currency manipulation. In his economics textbook, Dominick Salvatore defines an optimum tariff as

that rate of tariff that maximizes the net benefit resulting from the improvement in the nation’s terms of trade against the negative effect resulting from reduction in the volume of trade. . . . As the terms of trade of the nation imposing the tariff improve, those of the trade partner deteriorate, since they are the inverse. . . . Facing both a lower volume of trade and deteriorating terms of trade, the trade partner’s welfare definitely declines. As a result, the trade partner is likely to retaliate. . . . Note that even when the trade partner does not retaliate when one nation imposes the optimum tariff, the gains of the tariff-imposing nation are less than the losses of the trade partner, so that the world as a whole is worse off than under free trade. It is in this sense that free trade maximizes world welfare.[9]

If both countries play this game, both will be worse off. However, if only one country pursues this strategy, it can gain at its partner’s expense.

The Economic Effects of Trade Liberalization

The objective of reducing barriers to trade, of course, is to increase the level of trade, which is expected to improve economic well-being. Economists often measure economic well-being in terms of the share of total output of goods and services (i.e., gross domestic product, GDP) that the country produces per person on average. GDP is the best measurement of economic well-being available, but it has significant conceptual difficulties. As Joseph Stiglitz notes, the measurement of GDP fails “to capture some of the factors that make a difference in people’s lives and contribute to their happiness, such as security, leisure, income distribution and a clean environment—including the kinds of factors which growth itself needs to be sustainable.”[10] Moreover, GDP does not distinguish between “good growth” and “bad growth”; for example, if a company dumps waste in a river as a by-product of its manufacturing, both the manufacturing and the subsequent cleaning up of the river contribute to the measurement of GDP.

As the result of a multilateral round of trade negotiations under the GATT/WTO, tariffs are reduced during a transition period but are not completely eliminated. In the United States’ bilateral or regional free trade agreements (FTAs), however, parties to the agreement completely eliminate almost all tariffs on trade with each other, generally over a transition period, which may be five to ten years.

Although reducing barriers to trade generally represents a move toward free trade, there are situations when reducing a tariff can actually increase the effective rate of protection for a domestic industry. Jacob Viner gives an example: “Let us suppose that there are import duties both on wool and on woolen cloth, but that no wool is produced at home despite the duty. Removing the duty on wool while leaving the duty unchanged on the woolen cloth results in increased protection for the cloth industry while having no significance for wool-raising.”[11]

This happens for some products as a result of multilateral trade negotiations. For example, a country often reduces tariffs on products that are not import sensitive—often because they are not produced in that country—to a greater extent than it reduces tariffs on import sensitive products. In an FTA, where the end result is zero tariffs, this would not be an effect when the agreement is fully implemented. However, during the transition period it could well be relevant for some products. Other than this exception, however, reducing tariffs or other barriers to trade increases trade in the product, and this is the intent of the trade agreement.

The benefits to an economy from expanded exports as a trade partner improves market access are clear and indisputable. If the United States’ trade partner reduces barriers as a result of a trade agreement, U.S. exports will likely increase, which expands U.S. production and GDP. And suppliers to a firm that gains additional sales through exports will likely also increase their sales to that firm, thereby increasing GDP further.

The firms gaining sales through this may well hire more workers and possibly increase dividends to stockholders. This money is distributed through the economy a number of times as a result of what economists call the money multiplier effect, which states that for every $1 an individual receives as income, a portion of it will be spent (i.e., consumption) and a portion will be saved. If individuals save 10 percent of their income, for every $1 earned as income, 90 cents will be spent and 10 cents will be saved. The 90 cents that is spent then becomes income for another individual, and once again 90 percent of this will be spent on consumption. This continues until there is nothing left from the original $1 amount.

In fact, expanded exports increase a nation’s GDP by definition. One equation economists use for determining GDP is GDP = Domestic Consumption (C) + Domestic gross investment (In) + Government spending (G) + [Exports (E)—Imports (I )], or GDP = C + In + G + (E—I)

The impact of trade on GDP, therefore, is the net amount that exports exceed or are less than imports. However, this is a static measure. As noted above, expanded exports also have a dynamic effect as companies become more efficient as sales increase.

The economic impact of increased imports is different. By the economists’ definition of GDP, of course, increased imports reduce GDP. A way of looking at this is that if a U.S. firm produces a product that suddenly loses out to increased imports, it will reduce its production and employment, and consequently its suppliers will also reduce production and employment, thereby reducing economic output.

This would suggest that the mercantilists were right, that a nation would be well advised to restrict imports. However, almost all economists today would reject that conclusion, and in fact many economists believe that reducing its trade barriers benefits a country whether or not the country’s trade partners also reduce their barriers. Adam Smith and many economists after him argue that the objective of production is to produce goods for consumption. Stephen Cohen and his colleagues express this argument as follows: “The theories of comparative advantage (both classical and neoclassical) imply that liberalizing trade is always beneficial to consumers in any country, regardless of whether the country’s trading partners reciprocate by reducing their own trade barriers. From this perspective, the emphasis on the reciprocal lowering of trade barriers in most actual trade liberalization efforts . . . is misplaced.”[12]

The benefits of unilateral elimination of trade barriers are particularly obvious in those cases where the country does not produce the product; in these cases, eliminating trade barriers expands consumer choice. (As noted above, however, an exception to this occurs in situations where reducing a trade barrier on a raw material or component that is not produced by the country increases the effective rate of protection for the finished product.)

Even where the country does produce the product, increased competition from trade liberalization will likely lead to lower prices by the domestic firms. In this event, some of the consumer’s savings will then be spent consuming other products. The amount spent consuming other products will have positive production effects, which will somewhat mitigate the loss in production by the firm competing with the imports.

Increased import competition also has dynamic benefits by forcing domestic producers to become more efficient in order to compete in the lower price environment. Lower prices also may have a positive impact on monetary policy; because import competition reduces the threat of inflation, central banks can pursue a more liberal monetary policy of lower interest rates than otherwise would be the case. These lower rates benefit investment, housing, and other productive sectors.

Economic Models

Economists have developed a number of sophisticated models designed to simulate the changes in economic conditions that could be expected from a trade agreement. These models, which are based on modern economic theories of trade, are helpful where the barriers to trade are quantifiable, although the results are highly sensitive to the assumptions used in establishing the parameters of the model.

One type of model used extensively by economists to estimate the economy-wide effects of trade policy changes, such as the results of a multilateral trade round, is the Applied General Equilibrium Model, also called the Computable General Equilibrium (CGE) Model.[13] James

Jackson of the Congressional Research Service notes: “These models incorporate assumptions about consumer behavior, market structure and organization, production technology, investment, and capital flows in the form of foreign direct investment.”[14]

Xem thêm: Top 17 english was originally the language of england

CGE models may be used to estimate the impact of a trade agreement on trade flows, labor, production, economic welfare, or even the environment. They may consider the effects of the agreement on all countries involved, and are ex ante; that is, they attempt to forecast changes that would result from a trade agreement. General equilibrium models are based on input-output models, which track how the output of one industry is an input to other industries. General equilibrium models use enormous data inputs that reflect all the elements to be considered.[15]

One of the great strengths of these models is that they can show how the effects on industries flow through the entire economy. One of their disadvantages is that because of their complexity, the assumptions behind their projections are not always transparent. Economic models are useful to give a sense of what might happen as a result of a trade agreement. They give the appearance of being authoritative, but users need to be aware that economic models are not predictive of what will actually happen and that they have significant weaknesses.

First, the results of any model depend on the assumptions underlying it, such as the degree to which imported products and domestically produced products can be substituted for one another, or whether or not there is perfect or imperfect competition. Differing assumptions can produce a wide range of results, not only in magnitude but also sometimes even in the direction of projected changes.

Second, the economic data needed are often weak, not only for developing countries but even for the United States and other developed nations. For example, trade and economic data between countries, and even within countries, are not readily compatible. In the United States, the North American Industry Classification System (NAICS), which is used to collect statistical data describing the U.S. economy, is based on industries with similar processes to produce goods or services. In contrast, data on international trade in goods are collected on a commodity basis.[16] The United States’ NAFTA partners, Canada and Mexico, also use NAICS, but the European Union uses a system called Nomenclature of Economic Activities. Although there are concordances between these differing systems, these are far from exact.

Nontariff barriers—such as import quotas, subsidies, standards, and regulations—must be converted to their tariff equivalents, and this is often difficult and unreliable. For new areas covered in trade negotiations —such as services, investment, and intellectual property—efforts to measure the impact of barriers is even more difficult.

Although measuring the impact of tariffs is more accurate than measuring nontariff barriers or services, it is not as straightforward as it would seem. For example, often economists use a weighted tariff by considering the proportion of imports entering under that tariff line. A problem with this approach is that a very high duty will completely block imports, resulting in the false conclusion that that tariff line is given no weight.

In view of the problems with trade models, some economists dismiss their usefulness. For example, Bhagwati says: “I consider many of the estimates of trade expansion and of gains from trade—produced at great expense by number-crunching at institutions such as the World Bank with the aid of huge computable models…as little more than flights of fancy in contrived flying machines.”[17] Many economists would consider this criticism extreme, but nonetheless trade models do need to be viewed with a large degree of caution.

The Economic Theory of Trade Blocs

The drafters of the GATT believed that reducing barriers to trade should be on a multilateral basis to get the greatest benefits of expanded production based on comparative advantage. As noted above, they enshrined this concept in Article I of the GATT (most-favored-nation, MFN, treatment), which requires members to give equal treatment with regard to trade barriers to all GATT members.

However, they also recognized a role for regional integration that would allow the members of a trade bloc to eliminate barriers on trade among themselves, while maintaining a discriminatory tariff on imports from nonmembers.[18] Accordingly, Article XXIV of the GATT provides for a major exception to the MFN principle that allows countries to form customs unions or free trade areas (FTAs) that may discriminate against nonmembers of the bloc.[19] In a customs union, the members eliminate trade barriers among themselves but erect a common customs tariff on imports from nonmembers. Members of a free trade area also eliminate trade barriers among themselves, but they each retain their own schedule of tariffs on imports from nonmembers.

Customs unions and free trade area agreements may expand trade and global welfare or they may diminish welfare depending on whether they create new trade patterns based on comparative advantage or simply divert trade from a more competitive nonmember to a member of the trade bloc. In 1950, the economist Jacob Viner defined trade creation as the situation where a member of a preferential trading bloc has a comparative advantage in producing a product and is now able to sell it to its free trade area partners because trade barriers have been removed.

Trade creation benefits the exporters in the member of the trade bloc that has a comparative advantage in producing a product and it benefits consumers in the importing member who now can purchase the product at a lower price. Domestic producers competing with the lower-cost imports from its partner country lose, but their loss is less than the gains to the exporters and consumers. Trade creation enhances global welfare through this greater efficiency.

In the case of trade diversion, however, a member gains its sales at the expense of a more competitive producer in a country that is not a member of the bloc, simply because its products enter its partner’s market duty free, while the more competitive nonmember producer faces a discriminatory duty.[20] Nonmember country exporters that would have a comparative advantage under equal competitive conditions lose from trade diversion.

Additionally, under trade diversion, the importing country loses the tariff revenue it had collected on those imports which now come in duty free from its bloc partner. The consumer in the importing partner does gain, because the imported good no longer has to bear the cost of the tariff; however, the consumer’s gain is necessarily less than or equal to the lost customs revenue, so the nation as a whole is less well off . Thus, trade diversion hurts both the importing country and the rest of the world. These loses are greater than the gains to the bloc member that gains exports due to trade diversion.

If trade diversion is greater than trade creation, formation of the customs union or FTA would diminish world welfare. If trade creation is greater, then global welfare is enhanced.

In addition to trade diversion and trade creation, which are basically static effects, participants in free trade areas and customs unions are also seeking dynamic benefits, such as expanded production as firms take advantage of the increased size of the market to increase output, and improved efficiency as firms adapt to increased competition. Access to a larger market is particularly important for small countries whose economy is too small to justify large-scale production.

To minimize the potential adverse consequences of such trade blocs, GATT Article XXIV requires that the members of a customs union or an FTA must eliminate trade barriers on “substantially all” trade between them, and that all the members of GATT have the opportunity to review the agreement. In the event that a GATT member not a party to the customs union faces higher tariffs on some products as a customs union is formed, Article XXIV requires that that member be compensated for the lost trade. However, as noted in chapter 2, Article XXIV has proven to be totally ineffective in restricting the growth of trade blocs; as a result, trade patterns today are significantly distorted by these preferential schemes.

Trade Theory Meets New Realities

From the time of Adam Smith in 1776 to the launching of the GATT in 1947, economic theory of trade evolved fairly slowly. Since the GATT was launched in 1947, however, there have been a number of significant modifications to the traditional Western economic theory of international trade. These modifications largely update the basic theory of trade to reflect the new realities of industry and commerce.

In the times of Smith, Ricardo, and Hecksher-Ohlin, companies were generally small and most international trade was in agricultural or mineral products or produced by small scale manufacturing. By 1947, however, large-scale manufacturing had evolved, and a great deal of trade was in manufactured products.

In 1979, the economist Paul Krugman noted that a great deal of trade was taking place between developed countries that had similar factors of production. For example, the United States and the nations of Europe have broadly similar factors of production, yet conduct an enormous amount of trade generally within the same industries. Thus, the United States will export automobiles and auto parts to Europe and at the same time import autos and auto parts from Europe.

The Heckscher-Ohlin model, which is good at projecting likely trade patterns between countries where factors of production are different, really did not explain this trade pattern. Krugman’s theory is based on product differentiation and economies of scale. For example, a Jeep and a Volkswagen are both automobiles, but they are highly differentiated as seen by the consumer. And both benefit from economies of scale; that is, the larger the production, the more costs can be reduced within a broad range of volume. Unlike wheat, where costs increase as volume is expanded, the cost of each additional automobile produced declines as production is increased, although at a very large volume of production costs would likely start to increase. Goods such as automobiles require large, mechanized production runs and substantial capital investment, and it may be extremely difficult for a new entrant to compete with an established firm.

Under trade based on product differentiation and economies of scale, several countries may produce the same product broadly defined and trade parts and differentiated products with one another. Thus, the United States might specialize in producing Jeeps, and Europe might specialize in producing Volkswagens. Clearly, a great deal of production in modern developed country economies is in industries that experience increasing returns to scale, and in these industries returns to factors of production would not tend to equalize as a result of international trade. In fact, returns to labor in a labor scarce economy might well increase, rather than decrease, as would be predicted by the factor price equalization theory.

Western economic theory has also changed in recent years to account for the fact that world trade has increased so much more rapidly than overall economic growth since the early 1970s. In 1973, the ratio of exports to GDP was 4.9 percent for the United States, and by 2005 this had more than doubled to 10.2 percent. For the world as a whole, this ratio was 10.5 percent in 1973, increasing to 20.5 percent in 2005.

What caused exports to increase more rapidly than production is that companies evolved from being domestically oriented to becoming multinational, and now many have evolved to become global. The first six rounds of GATT trade negotiations had reduced developed-country tariffs on industrial goods from the average of 40 percent after World War II to less than half that level by the end of the Kennedy Round in 1967. Additionally, international communications and transportation had improved enormously (the first commercial jet crossed the Atlantic in 1958, and the first satellite for commercial telecommunications was launched in 1965.)

As a result companies in some industries, such as electronics and chemicals, became multinational corporations and increasingly began to purchase and produce parts and materials in a number of countries. Each time these parts and materials cross a border, an international trade transaction has occurred; and then, when the final good is exported, another international trade transaction has occurred.

This trend has increased enormously during the past twenty-five years, and now this cross-border trade occurs in virtually all industries. Many products will have parts and materials from many countries; for example, a new suit may have cotton from West Africa that has been processed into fabric in Bangladesh, and sewn into a suit in China, with buttons imported from India. And then the suit may be exported to the United States. Another example is the first Airbus jumbo jet 380, which had parts and components from more than 1,500 suppliers in twenty seven countries. Many companies today have global supply chains, procuring parts and materials worldwide. Each specific part or material in the value chain is sourced from the country that can produce the part most cheaply, whether because of its endowment of factors of production or because of special incentives, such as tax holidays.

Kei-Mu Yi of the World Bank notes that standard economic models account very well for the increase in world trade through the mid-1970s but cannot explain the growth of trade since then.[21] However, a model that accounts for supply chains does explain the growth in trade, and he believes that such vertical specialization accounts for about 30 percent of world trade today.

Yi notes that tariff reductions have a far greater impact on these global supply chains than they do on traditional trade. To take the suit example, assume that China, Bangladesh, and the United States each reduces its tariffs by 1 percent and that imported fabric and buttons account for half the cost of the suit made in China; then the cost of producing the suit in China will be reduced by 0.5 percent. Coupled with the 1 percent U.S. tariff reduction, the cost to the U.S. consumer would be reduced by 1.5 percent. If the suit had been wholly produced in China, the cost to the consumer would have been reduced by just the U.S. tariff reduction, or 1 percent.

The emergence of these extensive supply chains has enormous implications. It means that for many products the traditional concept of “country of origin” no longer applies, because many products have many countries of origin. This in turn means that standard trade statistics have limitations in how useful they are for understanding what is really happening in world trade.[22] It has an impact on how countries should approach economic development, because it means that developing countries must become part of these global supply chains as a way to increase the amount of value added in the parts and materials provided to these supply chains. And it has an impact on how companies see themselves—a firm selling globally and procuring its parts and materials globally sees itself as a “global” firm rather than as a “national” firm.

Trade in Factors of Production and Services

Traditional economic theory assumed that goods are traded between countries, but that factors of production (e.g., labor, capital, and technology) and services are not traded from country to country. However, recently capital, technology, and services have been increasingly flowing easily over national borders, and even labor is moving from country to country more frequently. Accordingly, in recent rounds of multilateral negotiations and in U.S. bilateral agreements, negotiators have sought to develop rules governing investment, intellectual property protection, services, and labor.

In economic theory, if factors of production are fully mobile, the costs of all factors of production that could move across borders would result in equal costs in all trading countries. This would mean that the basis of comparative advantage for trade between countries would diminish and there would ultimately be less international trade.

In reality, of course, there are reasons other than trade barriers why factors of production such as capital or labor may not move across borders, even when there are no barriers and higher returns could be gained in other markets. Workers, for example, are reluctant to leave their homelands and family and friends, and investors are reluctant to invest in other markets where they have less familiarity. As a result, even eliminating all governmentally imposed barriers to trade in capital and labor would not lead to the complete equalization of costs between counties.

Like trade in investment and capital, post-World War II economists did not conceive of trade in services. In fact, trade in services was almost considered an oxymoron by early economists, such as Adam Smith and David Ricardo, who assumed that services are not tradable. This was also the view of trade negotiators for three or more decades after the GATT was launched.

Geza Feketukuty, the lead U.S. negotiator on services in the Uruguay Round, gives a wonderful anecdote of early efforts to launch negotiations on trade in services: “The Swiss delegate . . . dismissed trade in services by pointing out how impossible it was for him to have his hair cut by a barber in another country. The chairman of the committee . . . replied that every woman in Germany had benefited enormously from French exports of hairdressing services, and she was confident that the delegate’s wife would confirm the same was true in Switzerland.”[23]

Not surprisingly, economic theory as it applies to services trade is still being developed. In general, economists today assume that the basic theory of comparative advantage as it applies to goods applies equally well to cross-border trade in services. As Geza Feketekuty says, “The theory of comparative advantage as a theoretical statement about economic relationships should be equally valid whether the products encompassed by the theory are tradable physical goods such as shoes and oranges, or tradable services such as insurance and engineering.”[24]

Many types of services, such as telecommunications, are intimately interconnected to other economic activity. Trade liberalization in these areas can have far-reaching economic effects. For example, lowering the costs and increasing the availability of telecommunications services can help manufacturers compete in global markets, it can enable farmers to learn the latest techniques, and it can help other services sectors, such as tourism, that can now reach the world market through the Internet. Liberalization of telecommunications services even facilitated the creation of a new form of enterprise, namely, “off shoring,” where companies moved some of their basic operations such as telemarketing call centers to low-cost locations in other countries.

In contrast, liberalizing restrictions in some other sectors, such as tourism, may affect revenues and employment for the providers and the country but will have only a minimal impact on the competitiveness of other sectors within the country. In other words, the liberalization of some services may have multiplier effects throughout the economy, whereas in other sectors the benefits will largely flow only to the affected sector.

Creating Comparative Advantage

The classic Western model of trade was based on eighteenth-century economic realities. Factors of production were relatively fixed: Land was immobile (although its fertility or usage might change), and labor mobility was highly restricted by political constraints. For most of the century, the movement of capital across borders was limited by political barriers and a lack of knowledge of other markets. (However, by the middle of the nineteenth century both capital and labor were flowing more freely between Europe and the Americas.) Technology in the eighteenth century was relatively simple by today’s standards and was relatively similar in all countries. Additionally, the production of most products at that time was subject to diminishing returns, which meant that as production increased, the costs of producing each additional unit increased.

In this world, the classic Ricardian model of trade provided a good explanation for trade patterns, such as which countries would produce what products. England would produce textiles based on its wool production and capital availability, and Portugal would produce wine based on its sunshine and fertile soil. If Portugal chose to impose barriers to the importation of British textiles, its own economy would be less well off, and it would still be in Britain’s interest to allow the free importation of Portuguese wine.

However, the world economy began to change in the twentieth century, as some products could be produced under conditions of increasing returns to scale. As a company produced more steel, production could be automated and the costs of each additional unit could be significantly reduced. And the same was true for automobiles and a growing number of other more sophisticated products.

By the last twenty-five years of the twentieth century, the global economy was significantly different. Land and labor were still relatively fixed, although capital could again move more freely around the world. However, technology was highly differentiated among countries, with the United States leading in many areas.

An established company in an industry that required extensive capital investment and knowledge had an enormous advantage over potential competitors. Its production runs were large, enabling it to produce product at low marginal cost. And the capital investment for a new competitor would be large.

Xem thêm: Top 10+ gdcd bài 3 lớp 11 đầy đủ nhất

In this new world, the economic policies pursued by a nation could create a new comparative advantage. A country could promote education and change its labor force from unskilled to semiskilled or even highly skilled. Or it could provide subsidies for research and development to create new technologies. Or it could take policy actions to force transfer of technology or capital from another country, such as allowing its companies to pirate technology from competitors or imposing a requirement that foreign investors transfer technology.

Ralph Gomory and William Baumol describe this well:

The underlying reason for these significant departures from the original model is that the modern free-trade world is so different from the original historical setting of the free trade models. Today there is no one uniquely determined best economic outcome based on natural national advantages. Today’s global economy does not single out a single best outcome, arrived at by international competition in which each country serves the world’s best interests by producing just those goods that it can naturally turn out most efficiently. Rather, there are many possible outcomes that depend on what countries actually choose to do, what capabilities, natural or human-made, they actually develop.[25]

In the world of the late twentieth century, a country might be dominant in an industry because of its innate comparative advantage, or it might be dominant because of a strong boost from government policy, or it might be dominant because of historical accident. For example, the U.S. dominance in aircraft was probably due to a strong educational system that produced highly competent engineers, a large domestic market with a dedicated customer (the U.S. military), and the historical accident that the aircraft industries of the United States’ major competitors—Japan, Germany, and England—had all been destroyed in World War II.

Once such an industry becomes dominant, it is extremely difficult for other countries’ industries to compete. The capital costs of entry may be very large, and it is difficult for a new entrant to master the technology. Additionally, the industry normally has a web of suppliers that are critical to competitiveness, such as steel companies and tire manufacturers. However, if such an industry losses its dominance, it is equally difficult for it to reenter the market.

A country with such a dominant industry benefits enormously economically. Because of its dominant position, such an industry may pay high wages and provide a stable base of employment.

Access to other markets plays an important role in this economic model where comparative advantage can be created. Without free trade, it becomes extremely costly for a government to subsidize a new entrant because the subsidy must be large enough both to overcome foreign trade barriers and to jump-start the domestic producer. The WTO and the United States’ FTAs also play an important role by setting out rules that govern what actions a country may take in many areas to create comparative advantage; for example, the subsidies code limits the type of subsidies that governments may grant.

Gomory and Baumol note that because countries can create a comparative advantage in goods with decreasing costs of production, there are many possible outcomes to trade patterns: “These outcomes vary in their consequences for the economic well-being of the countries involved. Some of these outcomes are good for one country, some are good for the other, some are good for both. But it often is true that the outcomes that are the very best for one country tend to be poor outcomes for its trading partner.”[26]

Although country policies can lead to creation of a dominant industry, such an industry may not be as efficient as if it had occurred in another country. An example given by Gomory and Baumol is Japan’s steel industry. Japan has no domestic energy supplies and high wages; by contrast, China “has low labor costs and lots of coal.”[27] In theory, China would be the efficient producer of steel, but in reality Japan is the dominant producer. (This example is less valid today, as China has become a major steel producer.)

Although there are many areas where government policies can create comparative advantage, there are still many areas where the classic assumptions of an inherent comparative advantage still hold. The key is whether the industry is subject to constant or increasing costs, such as wheat, or decreasing costs, such as autos, aircraft, or semiconductors.

Neomercantilism

The economic theory based on Ricardo’s concept of comparative advantage dominates current thinking in the West and formed the intellectual basis for formation of the GATT/WTO. The doctrine of mercantilism, which dominated thinking up to the end of the eighteenth century, is generally rejected by Western economists today.

However, a number of countries—including Japan, South Korea, China, and some other countries in the Far East—have pursued a neomercantilism model in which they seek to grow through an aggressive expansion of exports, coupled with a very measured reduction of import barriers. These countries seek to develop powerful export industries by initially protecting their domestic industry from foreign competition and providing subsidies and other support to stimulate growth, often including currency manipulation.

The success of some countries pursuing a neomercantilist strategy does not refute the law of comparative advantage. In fact, the reason these countries are successful is that they focus on industries where they have or can create a comparative advantage. Thus Japan first focused on industries such as steel and autos, and later on electronics, where a policy of import protection and domestic subsidies could enable their domestic firms to compete in world markets, and particularly the U.S. market.

To succeed in a neomercantilist strategy, of course, a country needs access to other markets, which the progressive liberalization of trade barriers under the GATT/WTO provided. Neomercantilists generally focus on key industries selected by government, a strategy known as industrial policy. A successful industrial policy requires a farsighted government. Japan had an extremely competent group of government officials in the Ministry of Industry and Trade (MITI), which oversaw its industrial policy and was basically immune from political pressures. Although MITI had many successes, it also made some missteps. For example, in their planning to develop a world-class auto industry in the 1950s, MITI officials initially believed they had too many auto companies, and urged Honda to merge with another company. Instead, Honda elected to invest in the United States and went on to become a leading auto producer.

Countries pursuing the neomercantilist model have also generally promoted education and high domestic savings to finance their growing export industries. For example, the savings rate in Japan has often been more than 20 percent of GDP, and it approaches 40 percent of China’s GDP today. (By contrast, the U.S. savings rate has been only about 2 percent over the past decade and in some years was actually negative.)

Many economists argue that a neomercantilist strategy may be successful for a while but that over time such a strategy will not be effective. Basically this argument is that the complexities for governments in picking potential winners and identifying how to promote those industries are too great. For example, Japan was very successful with its neomercantilist strategy until the mid-1990s. However, since then the Japanese economy has been stagnating, and many economists believe that Japan will need to change its approach to stimulating domestic demand rather than focusing on export markets. During the past ten years, South Korea and China have also pursued neomercantilist policies, and it remains to be seen if these are effective over the long term.

Additionally, a number of economists argue that government intervention can be effective in promoting a specific sector but that industrial policies are not effective at the macro level of benefiting the economy as a whole. In any case, Western economists and policymakers today almost universally reject the idea that the United States should adopt an industrial policy that picks winners and losers. Opponents of a possible U.S. industrial policy argue that under the U.S. system, such a policy would be subject to political pressures that would ensure failure.

Instead, the real debate among economists and policymakers is whether the United States should respond to foreign neomercantilist practices, and if so, how. Stephen Cohen and his colleagues say:

Free trade advocates argue that imposing import barriers, even if other countries do so, is tantamount to shooting oneself in the foot. The advisability of turning the other cheek to other countries’ trade barriers is based on an economic argument traceable to Adam Smith in the eighteenth century: Since consumption is the sole end of production, consumers’ interests come before producers’ interests, especially those of relatively inefficient producers. Carried to its logical conclusion, this strategy recommends that the U.S. government take no action to offset the de facto subsidies provided to domestic consumers when imports are sold at prices below fair value.[28]

Others argue that the objective of free trade is to promote competition based on comparative advantage, which maximizes global efficiency. Practices such as subsidies or currency manipulation are a movement away from such competition and can produce a result where the less efficient producer dominates trade, thereby reducing total welfare. In these circumstances, taking an offsetting action, such as imposing a countervailing duty, could restore “a level playing field” where trade based on comparative advantage can occur.

Unbalanced Trade

The theory of comparative advantage assumes a world where trade between countries is in balance or at least where countries have a trade surplus or deficit that it is cyclical and temporary.[29] Relaxing the assumption “that international trade among nations is balanced, could lead a nation with a trade deficit to import some commodities in which it would have a comparative advantage and it would in fact export with balanced trade,” says Dominic Salvatore. However, he does not see this as a big problem “since most trade imbalances are generally not very large in relation to GNP [gross national product].”[30]

In analyzing the impact of a surplus or deficit, economists often consider “trade” very broadly in definition. Generally, economists do not consider the simple balance in merchandise trade as relevant as the “current account,” which includes the balance of trade for goods and services, plus net international income receipts (remitted profits from overseas investments, royalty payments, interest, and dividends) and unilateral transfers (foreign aid and transfers abroad by private citizens). Except for unilateral transfers, all these elements are covered in our trade agreements.

To give a real picture of how the nation is doing, the current account is often measured as a percentage of GDP; as a country grows, a larger surplus or deficit in the current account is not a source of concern because the economy can more readily absorb the impact.

A surplus or deficit in the current account can be affected by the business cycle. Thus, if our economy grows rapidly, the demand for imports will expand as consumers can afford to buy more and businesses need parts and supplies for expansion. Similarly, the United States’ exports are affected by economic growth in its trade partners. If it grows more rapidly than its trade partners, in short, that will have a negative impact on the U.S. current account balance. Conversely, if the United States’ trade partners are growing more rapidly, that will have a positive impact on its current account balance.

Economists are not concerned with such cyclical trade deficits or surpluses. Additionally, they are not concerned if a deficit occurs because the country is borrowing heavily from abroad to finance investment that will be paid back later. During the nineteenth century, in fact, the United States was in exactly this position when it borrowed heavily to build railroads across the continent, steel mills, and other long-term investments. However, that is not the United States’ situation today. Today, it is borrowing heavily from other countries to finance short-term consumption, such as the newest and largest HDTVs from Japan or South Korea, and these purchases do not generate income to repay its debt in the future.

A fundamental accounting concept in international economics is that a country’s overall balance of payments, which consists of both the current account and the capital account, has to be in balance. This means that if the current account is in deficit, the country’s capital account has to be in surplus by an equal amount. The capital account consists of purchases or sales of foreign exchange by the central bank or by private citizens. This fundamental accounting principal can be seen as:

Balance of Payments = Current Account + Capital Account = Zero

Two factors that may lead to a deficit or surplus in the current account balance are the level of a nation’s savings and investment compared with consumption, and the exchange rate between its currency and that of its trade partners. The level of a country’s savings and investment compared with its consumption is inversely related to its trade balance. Joseph Stiglitz puts the matter as follows: “Trade deficits and foreign borrowing are two sides of the same coin. If borrowing from abroad goes up, so too will the trade deficit. This means that if government borrowing goes up, unless private savings goes up commensurately (or private investment decreases commensurately), the country will have to borrow more abroad, and the trade deficit will increase…The reserve country can be thought of as exporting T-bills” in exchange for the import of goods and services.[31]

The second factor that can have an impact on a country’s current account balance is the exchange rate. The exchange rate refers to the amount of foreign currencies that can be purchased by a country’s own currency. According to economic theory, if a nation is running a persistent trade deficit, its exchange rate would be expected to fall in relation to its trade partners—for example, if the United States runs a persistent deficit, the dollar should purchase less foreign exchange such as euros or yen. This would mean that imported products will cost more, because it would take more dollars for each unit of foreign currency, and this would cause imports to decline. Additionally, the United States’ exports should expand, as foreigners can buy more of its products for each unit of their currency.

However, countries can prevent this mechanism from operating by aggressively intervening in the foreign exchange markets. For example, under economic theory, the value of the dollar should decline in relation to the renminbi because the United States has enormous deficits while

China experiences comparable trade surpluses. However, China has pegged the renminbi to the dollar and has prevented its exchange rate from rising and thereby restoring a trade balance. China does this by using the dollars it accumulates from its trade surplus to aggressively purchase U.S. currency in the form of Treasury bills. The result has been an overvalued dollar and an undervalued renminbi. (This is similar to what Japan did in the early 1980s when the yen was undervalued and the dollar was overvalued.) In economic theory, an “undervalued exchange rate is both an import tax and an export subsidy and is hence the most mercantilist policy imaginable.”[32]

Conclusion

Most economists today consider the law of comparative advantage to be one of the fundamental principles of economics. However, several very important caveats to the law of comparative advantage are often overlooked or glossed over.

First, David Ricardo based his theory on the assumption that the costs of production increase as production expands; in other words, each additional unit produced costs more than the previous unit, and this is true for many products, such as wheat. This assumption implies that countries have a comparative advantage in certain goods because of their natural endowment. However, many products today are produced under conditions of decreasing costs; for example, the cost of producing each additional semiconductor or airplane decreases as production expands. The extremely important implication of this is that countries can create comparative advantage.

A second extremely important caveat is the so-called factor price equalization theorem, which holds that international trade will cause the relative returns to factors of production, such as unskilled labor, to equalize between countries under free trade conditions. This would mean that for a high-wage country such as the United States, wages for unskilled workers would fall while wages in labor abundant countries would rise. However, factor prices will not tend to equalize in industries that have decreasing costs of production.

Third, Ricardo and other early economists based their theories on trade in goods, and they did not consider trade in factors of production. Today, however, basic factors of production such as labor, capital, and technology are traded. The implication of trade in factors of production is that factor equalization will occur completely in a shorter time period than would occur under trade in goods only.

Fourth, Western economic theory assumes that trade will be reasonably balanced over time. Where this is not the case, it indicates that the deficit country will be importing products where it would normally have a comparative advantage; if these products are in areas that experience decreasing costs of production, over time the industry may lose its ability to compete in global markets.

The world has changed since the time of Smith and Ricardo. Today, trade is no longer mostly between small producers and farmers but giant global corporations that buy parts and materials from around the world and sell globally. These giant supply chains were made possible by trade liberalization and technology changes, and they account for the fact that international trade has expanded far more rapidly than global economic growth since 1970. These global supply chains also have implications for strategies for developing countries in promoting economic growth.

Clearly, the United States benefits when its trade partners reduce their trade barriers, because its exports will increase, which generates expanded production and employment. Most economists also believe that the United States benefits from reducing its own trade barriers, as consumers gain from reduced costs and producers are forced by international competition to improve efficiency. However, import liberalization has an impact on domestic labor and production that needs to be considered.

Multilateral trade liberalization, where all countries reduce their trade barriers in parallel, best promotes trade based on comparative advantage. However, countries can abuse the system by adopting beggar-thy-neighbor poli

[1] Thomas Mun, in a letter written to his son in the 1630s, available at http://socserv.mcmaster.ca/econ/ugcm/3ll3/mun/treasure.txt.

[2] William Bernstein notes that Smith was not the first to advocate the advantages of free trade. He says, “By far the most remarkable early free-trader was Henry Martyn, whose Considerations upon the East India Trade preceded by seventy-five years Adam Smith’s Wealth of Nations.” William J. Bernstein, A Splendid Exchange: How Trade Shaped the World (New York: Grove Press, 2008), 258.

Xem thêm: Top 10 sư tử và kiến càng

[3] David Ricardo, On the Principles of Political Economy and Taxation (London: John Murray, 1821).

[4] Bertil Ohlin actually published this theory in 1933. A brief explanation of the Heckscher-Ohlin theory is available at http://nobelprize.org/educational_games/economics/trade/ohlin.html.

[5] Dominick Salvatore, International Economics, 8th ed. (Hoboken, N.J.: John Wiley & Sons, 2004), 15.

[6] The concept of product life cycle was introduced by Raymond Vernon in 1966.

[7] A good explanation of this theorem, which shows a hypothetical trading relationship between two countries, is available at http://faculty.washington.edu/danby/bls324/trade/hos.html.

[8] James K. Jackson, Trade Agreements: Impact on the U.S. Economy (Washington, D.C.: Congressional Research Service, 2006), 9.

[9] Salvatore, International Economics, 255.

[10] Stiglitz, Progress, What Progress, 27.

[11] Jacob Viner, The Customs Union Issue (New York: Carnegie Endowment for International Peace, 1950), 48.

[12] Stephen D. Cohen, Robert A. Blecker, and Peter D. Whitney, Fundamentals of U.S. Foreign Trade Policy: Economics, Politics, Laws, and Issues (Boulder, Colo.: Westview Press, 2003), 57.

[13] A commonly used and publicly available CGE model and comprehensive database is available from the Global Trade Analysis Project, which is housed in the Department of Agricultural Economics at Purdue University. The GTAP model and database are available at https://www.gtap.agecon.purdue.edu/default.asp.

[14] Jackson, Trade Agreements, 12.

[15] A second type of model commonly used is a gravity model, which assumes that larger economies have a greater pull on trade flows than smaller economies, and that proximity is an important factor affecting trade flows. And still another common type is a partial equilibrium model, which estimates the impact of a trade policy action on a specific sector, not the general economy. Partial equilibrium models do not capture linkages with other sectors and accordingly are useful when spillover effects are expected to be negligible. However, partial equilibrium models are more transparent than CGE models and it is easier to see the impact of changed assumptions.

[16] A good source for trade data and an explanation of the data systems used is the Foreign Trade Statistics Web site at the Census Bureau, http://www.census.gov/eos/www/naics/.

[17] Jagdish Bhagwati, In Defense of Globalization, Council on Foreign Relations Report (New York:, Oxford University Press, 2004), 230.

[18] The drafters of the GATT probably were focused on the potential benefits of a European customs union that would promote integration. Some historians argue that the U.S. negotiators also envisioned a possible U.S.-Canadian free trade agreement that would eliminate barriers to trade in North America.

[19] Another major exception to the MFN rule pertains to preferences for developing countries. This exception is considered further in chapter 6.

[20] Viner notes a qualification to the rule that global welfare is diminished if trade diversion is greater than trade creation and that is when unit costs decrease in an industry as output expands. In such a case, a small country may not have been able to develop an industry because its market size was too small but is able to develop the industry within a customs union or free trade arrangement.

[21] Kei-Mu Yi, Can Vertical Specialization Explain the Growth of World Trade? (New York: Federal Reserve Bank of New York, 1999).

[22] WTO deputy director-general Alejandro Jara gave an interesting speech May 26, 2010, in which he outlined some of the implications of supply chains for how we think about international trade. His speech is available at www.wto.org/english/news_e/news10_e/devel_26may10_e.htm.

[23] Geza Feketekuty, International Trade in Services: An Overview and Blueprint for Negotiations (Cambridge, Mass.: American Enterprise Institute /Ballinger, 1988), 2-3.

[24] Ibid., 100.

[25] Ralph Gomory and William Baumol, Global Trade and Confl icting National Interests (Cambridge, Mass.: MIT Press, 2000), 5.

[26] Ibid., 5

[27] Ibid., 21.

[28] Cohen, Blecker, and Whitney. Fundamentals of U.S. Foreign Trade Policy, 8-9.

[29] See, e.g., ibid., 54: “The theory of comparative advantage assumes that trade is balanced (i.e., exports equal imports in value) and that labor is fully employed…If trade is not balanced, the surplus country must be exporting some goods in which it does not have a ‘true’ comparative advantage.”

[30] Salvatore, International Economics, 167.

[31] Joseph E. Stiglitz, Making Globalization Work (New York: W. W. Norton, 2006), 252-53.

[32] Aaditya Mattoo and Arvind Subramanian. Currency Undervaluation and Sovereign Wealth Funds: A New Role for the World Trade Organization (Washington, D.C.: World Bank, 2008), 3.

Chapter Updates

Home

Chapter 1: U.S. Trade Policy in Crisis

Chapter 2: America’s Trade Agreements

Chapter 3: Trade Agreements and Economic Theory

Chapter 4: Trade Agreements and U.S. Commercial Interests

Chapter 5: Foreign Policy: The Other Driver

Chapter 6: Economic Development: A Missed Opportunity

Chapter 7: Uneasy Neighbors: Trade and the Environment

Chapter 8: The Labor Dilemma

Chapter 9: The Way Forward

For more information or questions contact William Krist at william.krist@wilsoncenter.org

Top 19 his policies were beneficial to the economy as a whole tổng hợp bởi Lambaitap.edu.vn

His policies were beneficial to the economy as … – hoidapvietjack.com

- Tác giả: hoidapvietjack.com

- Ngày đăng: 03/20/2022

- Đánh giá: 4.92 (799 vote)

- Tóm tắt: His policies were beneficial to the economy as a whole. A. harmless. B. crude. C. harmful. D. good. Trả Lời. Hỏi chi tiết.

- Nguồn: 🔗

His policies were beneficial to the economy as a whole

- Tác giả: moon.vn

- Ngày đăng: 08/07/2022

- Đánh giá: 4.46 (474 vote)

- Tóm tắt: His policies were beneficial to the economy as a whole. His policies were beneficial to the economy as a whole. A. harmless. B. crude. C. detrimental.

- Nguồn: 🔗

The Reagan Presidency

- Tác giả: reaganlibrary.gov

- Ngày đăng: 05/16/2022

- Đánh giá: 4.39 (315 vote)

- Tóm tắt: Reagan’s economic policies highlighted his long-standing dislike of high … Americans continued to buy more foreign-made goods than they were selling.

- Khớp với kết quả tìm kiếm: Few presidents have enjoyed the affection of so many of the American people. Support for Ronald Reagan grew when he was seriously wounded by an assassin’s bullet in 1981 and during major surgical procedures in 1985 and 1987. Reagan was known as the …

- Nguồn: 🔗

His policies were beneficial to the economy as a whole

- Tác giả: hoctapsgk.com

- Ngày đăng: 06/24/2022

- Đánh giá: 4.06 (316 vote)

- Tóm tắt: His policies were beneficial to the economy as a whole. A. harmless B. crude C. harmful D. goodTrang tài liệu, đề thi, kiểm tra website giáo dục Việt Nam.

- Nguồn: 🔗

Xem thêm: Top 19 vật có mặt phản xạ hình cầu

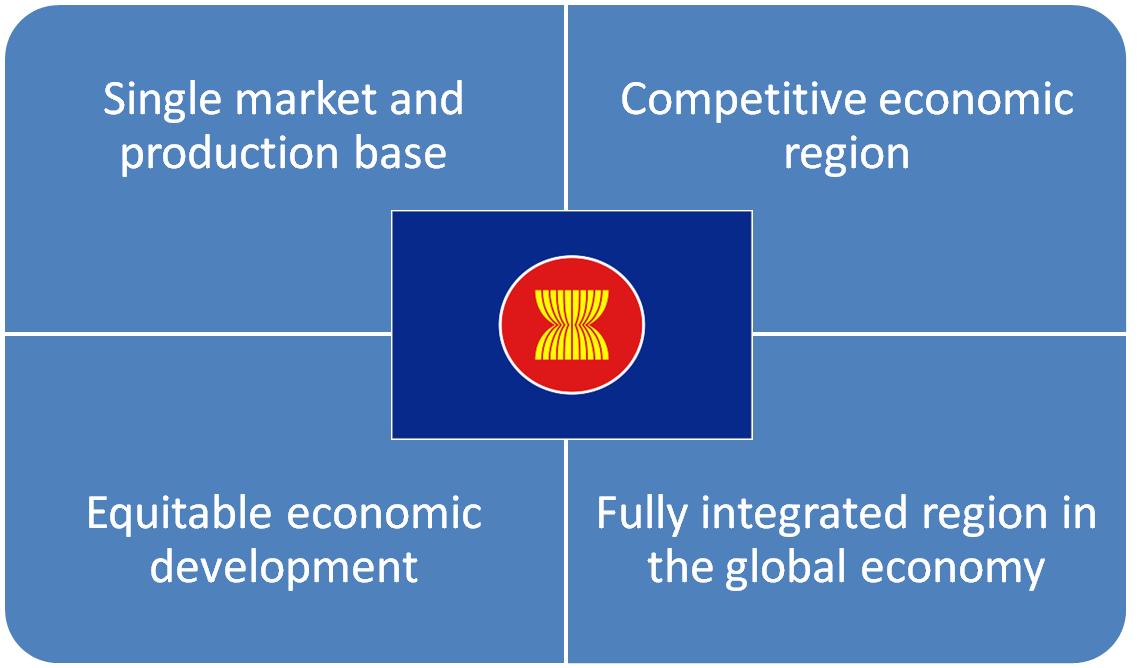

About AEC | ASEAN Economic Community

- Tác giả: investasean.asean.org

- Ngày đăng: 06/21/2022

- Đánh giá: 3.79 (344 vote)

- Tóm tắt: Through Bali Concord II, ASEAN leaders committed to maximize opportunities for mutually beneficial regional integration and declared the AEC as one of the …

- Khớp với kết quả tìm kiếm: Once AEC is realised, ASEAN will be characterized by free movement of goods, services, and investments as well as freer flow of capital and skills. With harmonised trade and investment laws, ASEAN, as a rules-based organisation will be strengthened …

- Nguồn: 🔗

How Education and Training Affect the Economy

- Tác giả: investopedia.com

- Ngày đăng: 01/13/2022

- Đánh giá: 3.6 (384 vote)

- Tóm tắt: Education and training benefit not only the worker but also the employer and the country as a whole.

- Nguồn: 🔗

The Importance of Competition for the American Economy

- Tác giả: whitehouse.gov

- Ngày đăng: 01/27/2022

- Đánh giá: 3.52 (355 vote)

- Tóm tắt: It launches a whole-of-government effort to combat growing market power in the U.S. economy by seeking to ensure that markets are …

- Khớp với kết quả tìm kiếm: In order to figure out whether the patterns of increased concentration and markups are problematic, economists must look more closely at individual markets, since market-specific studies allow a more detailed understanding of the competitive …

- Nguồn: 🔗

His policies were beneficial to the e

- Tác giả: cunghocvui.com

- Ngày đăng: 03/18/2022

- Đánh giá: 3.35 (480 vote)

- Tóm tắt: Câu hỏi: His policies were beneficial to the economy as a whole. A. harmless. B. crude. C. harmful.

- Nguồn: 🔗

BRIA 23 1 a Adam Smith and The Wealth of Nations

- Tác giả: crf-usa.org

- Ngày đăng: 01/15/2022

- Đánh giá: 3.19 (400 vote)

- Tóm tắt: As the American Revolution began, a Scottish philosopher started his own economic revolution. In 1776, Adam Smith published The Wealth of Nations, …

- Khớp với kết quả tìm kiếm: We know Adam Smith today as the father of laissez faire (“to leave alone”) economics. This is the idea that government should leave the economy alone and not interfere with the “natural course” of free markets and free trade. But he was mainly …

- Nguồn: 🔗

Xem thêm: Top 11 columbus was one of

His policies were beneficial to the economy as a whole

- Tác giả: doctailieu.com

- Ngày đăng: 07/22/2022

- Đánh giá: 2.79 (98 vote)

- Tóm tắt: Câu Hỏi: Tìm từ trái nghĩa với từ được gạch chân trong câu: His policies were beneficial to the economy as a whole. A. harmless. B. crude.

- Nguồn: 🔗

His policies were beneficial to the economy as a whole. A. harmless

- Tác giả: hoc24.vn

- Ngày đăng: 02/20/2022

- Đánh giá: 2.79 (69 vote)

- Tóm tắt: His policies were beneficial to the economy as a whole. A. harmless B. crude C. harmful D. good.

- Nguồn: 🔗

Hỏi: His policies were beneficial to the economy as a whole

- Tác giả: 7scv.com

- Ngày đăng: 08/26/2022

- Đánh giá: 2.7 (57 vote)

- Tóm tắt: Hỏi: His policies were beneficial to the economy as a whole. A. harmless B. crude C. harmful D. good.

- Nguồn: 🔗

His policies were beneficial to the economy as a whole

- Tác giả: tracnghiem.net

- Ngày đăng: 09/12/2022

- Đánh giá: 2.5 (91 vote)

- Tóm tắt: His policies were beneficial to the economy as a whole. A. harmless. B. crude. C. harmful.

- Nguồn: 🔗

The New Deal (article) – The Great Depression – Khan Academy

- Tác giả: khanacademy.org

- Ngày đăng: 06/07/2022

- Đánh giá: 2.55 (58 vote)

- Tóm tắt: The New Deal was a set of domestic policies enacted under President Franklin … 1933 the nation had been spiraling downward into the worst economic crisis …

- Nguồn: 🔗

Xem thêm: Top 18 cảnh quan chủ yếu của đông nam á

The EU – what it is and what it does

- Tác giả: op.europa.eu

- Ngày đăng: 11/23/2021

- Đánh giá: 2.45 (69 vote)

- Tóm tắt: The first steps were to foster economic cooperation: the idea being that … the European Commission, which represents the interests of the EU as a whole.

- Khớp với kết quả tìm kiếm: The EU has delivered more than half a century of peace, stability and prosperity, helped raise living standards and launched a single European currency: the euro. More than 340 million EU citizens in 19 countries now use it as their currency and …

- Nguồn: 🔗

13. Informal Economy (Decent work for sustainable … – ILO

- Tác giả: ilo.org

- Ngày đăng: 07/07/2022

- Đánh giá: 2.24 (127 vote)

- Tóm tắt: Policies to promote the transition to the formal economy. 1. Targeted policies for specific groups of workers and economic units in the informal economy.

- Nguồn: 🔗

His policies were beneficial to the economy as a whole

- Tác giả: tuhoc365.vn

- Ngày đăng: 12/03/2021

- Đánh giá: 2.11 (178 vote)

- Tóm tắt: His policies were beneficial to the economy as a whole. A. harmless. B.

- Nguồn: 🔗

The U.S. Economy in the 1920s

- Tác giả: eh.net

- Ngày đăng: 06/22/2022

- Đánh giá: 2.05 (124 vote)

- Tóm tắt: Alexander Field (2003) has argued that the 1930s were the most technologically progressive decade of the twentieth century basing his argument on the growth of …

- Nguồn: 🔗

Unit 17 The Great Depression, golden age, and global financial crisis

- Tác giả: core-econ.org

- Ngày đăng: 02/08/2022

- Đánh giá: 1.98 (80 vote)

- Tóm tắt: There have been three distinctive economic epochs in the hundred years … The policies adopted in response to the end of the golden age restored high …

- Khớp với kết quả tìm kiếm: The great moderation masked three changes that would create the environment for the global financial crisis. While to some extent these changes were shared across most advanced economies, actors in the US economy played a pivotal role in the global …

- Nguồn: 🔗